megacity

3 min read

Is there a great tech war like a dystopian novel in 2024?

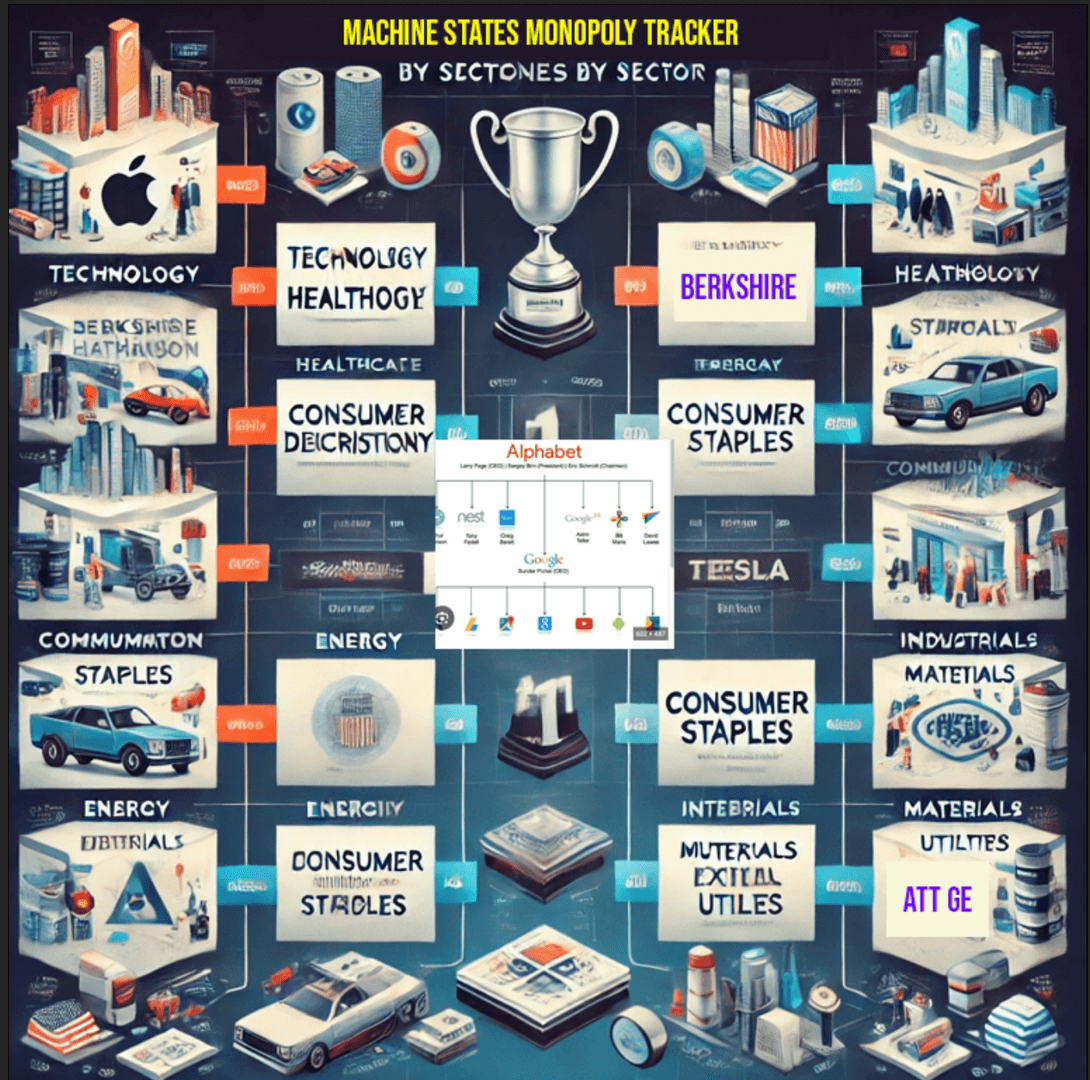

in Machine States there is a monopoly tracker. fiction…or Is it reality. Here is a conversation about the winner of USA MONOPOLY… With 4o OPEN AI picked… Alphabet to win… Technology Sector: Apple In

in Machine States there is a monopoly tracker. fiction…or Is it reality. Here is a conversation about the winner of USA MONOPOLY…

With 4o

OPEN AI picked… Alphabet to win…

- Apple Inc.: $3.39 trillion

- NVIDIA Corporation: $3.32 trillion

- Microsoft Corporation: $3.05 trillion

- Alphabet Inc.: $2.10 trillion

- Amazon.com Inc.: $2.08 trillion

- Meta Platforms Inc.: $1.29 trillion

- Broadcom Inc.: $792.87 billion

- Tesla Inc.: $786.84 billion

- Oracle Corporation: $397.89 billion

- Adobe Inc.: $256.44 billion

- Salesforce Inc.: $255.03 billion

- Advanced Micro Devices Inc. (AMD): $277.84 billion

- Cisco Systems Inc.: $250 billion

- Intel Corporation: $132.94 billion

Healthcare Sector: - Eli Lilly and Company: $808.65 billion

- Johnson & Johnson: $350.63 billion

- Merck & Co., Inc.: $318.75 billion

- AbbVie Inc.: $295.34 billion

- UnitedHealth Group Incorporated: $450.89 billion

Financials Sector: - Berkshire Hathaway Inc.: $887.16 billion

- JPMorgan Chase & Co.: $599.29 billion

- Visa Inc.: $550.38 billion

- Mastercard Incorporated: $416.63 billion

- Bank of America Corporation: $316.02 billion

Consumer Discretionary Sector: - Tesla Inc.: $786.84 billion

- The Home Depot, Inc.: $330.84 billion

Consumer Staples Sector: - Walmart Inc.: $542.78 billion

- The Procter & Gamble Company: $386.66 billion

- Costco Wholesale Corporation: $392.65 billion

Energy Sector: - Exxon Mobil Corporation: $514.81 billion

- Chevron Corporation: $282.20 billion

Communication Services Sector: - Alphabet Inc.: $2.10 trillion

- Meta Platforms Inc.: $1.29 trillion

- Netflix, Inc.: $294.09 billion

Industrials Sector: - General Electric Company: $92.70 billion

Materials Sector: - The Sherwin-Williams Company: $95.88 billion

Utilities Sector: - The Southern Company: $95.78 billion

These companies represent the leading entities in their respective sectors, reflecting the diverse landscape of the U.S. economy. (Disfold)

In the tech economy, major categories include: - Software Development: Creation of operating systems, applications, and software solutions.

- Hardware Manufacturing: Production of physical devices like computers, smartphones, and networking equipment.

- Semiconductors: Design and fabrication of microchips and integrated circuits.

- Cloud Computing: Provision of on-demand computing resources and services over the internet.

- Artificial Intelligence (AI) and Machine Learning: Development of systems that can perform tasks requiring human intelligence.

- Cybersecurity: Protection of systems, networks, and programs from digital attacks.

- E-commerce: Online buying and selling of goods and services.

- Social Media and Digital Communication: Platforms facilitating online interaction and content sharing.

- Fintech: Integration of technology into financial services to improve user experience and efficiency.

- Telecommunications: Transmission of information over significant distances through electronic means.

These categories encompass the primary areas driving innovation and growth within the technology sector.

- Technology: Tech giants Apple and NVIDIA clash, with Apple leveraging its consumer influence and brand loyalty to edge out NVIDIA. Microsoft, too, holds strong in software, narrowly defeating Oracle and cloud rival Amazon.

- Healthcare: Eli Lilly’s advancements in biotech give it an edge over the traditionally dominant Johnson & Johnson, capitalizing on a dystopian shift towards personalized, data-driven healthcare.

- Financials: Berkshire Hathaway’s diversified empire goes head-to-head with JPMorgan Chase. Buffett’s conglomerate narrowly triumphs, pivoting away from traditional finance and leveraging massive assets for real-world influence.

- Energy: Exxon Mobil and Chevron enter a brutal resource standoff. Exxon Mobil prevails, backed by high-stakes lobbying and control over strategic energy assets.

- Consumer Staples: Walmart, embodying a digital marketplace dystopia, outmaneuvers Procter & Gamble through sheer logistical dominance and aggressive pricing.

- Communication Services: Alphabet and Meta (formerly Facebook) compete fiercely. Alphabet, wielding superior data control, outpaces Meta’s social influence, cementing itself as the dystopian information overlord.

- Industrials: General Electric secures its place by adapting heavily into tech-driven manufacturing, dominating the sector with aggressive AI-driven industrial practices.

Semi-Finals: The Consolidation - Berkshire Hathaway vs. Walmart: Berkshire leans into Walmart’s distribution channels, creating a financial ecosystem that controls both currency flow and consumer goods. Warren Buffett’s foresight merges finance and retail dominance.

- Exxon Mobil vs. Alphabet: Exxon’s control over energy supplies faces Alphabet’s data-driven insights. In a surprising twist, Alphabet’s AI algorithms predict and manipulate market behavior so precisely that Exxon’s reliance on physical resources becomes a disadvantage. Alphabet wins, harnessing energy distribution with predictive technology.

- Apple vs. Eli Lilly: Apple’s health tech offerings merge with Eli Lilly’s biotech dominance. Apple’s closed ecosystem proves more adaptable, making it the final tech-health hybrid juggernaut.

Final Battle: Apple, Alphabet, and Berkshire Hathaway

• Apple’s Health-Tech Empire: Leveraging its extensive user data, Apple dives into biotech, offering data-driven wellness solutions and personal health ecosystems. This technology-controlled health service now intertwines with its global product market.

• Alphabet’s Data Monopoly: Alphabet emerges as the ultimate controller of information, health, and lifestyle, leveraging its tech to monitor, predict, and influence user behavior worldwide. They control everything from resources to personal information flows.

• Berkshire Hathaway’s Financial Fortress: With stakes in nearly every other sector, Berkshire pivots to being the primary controller of resources, leveraging long-standing assets and a “financial-net” system that binds consumers to its ecosystem.

Ultimate Winner: Alphabet

In this dystopian future, Alphabet takes the crown with a complete stranglehold on data, influence, and prediction. Their AI-driven strategies bypass traditional resources, making them indispensable to all sectors. With user data driving decisions across health, finance, and energy, Alphabet becomes the ultimate ruler of this dystopian corporate world, shaping decisions before consumers even make them.

Watch out fools or become kaiote food.

Latest

More from the site

Megacity

🪞[UPDATE TRANSMISSION: HYPERFY v0.9.0 – SYSTEM SHIFT IN PROGRESS…

🪞[UPDATE TRANSMISSION: HYPERFY v0.9.0 – SYSTEM SHIFT IN PROGRESS] From the depths of MegaCity’s fractured codebase, a new pulse just hit the network. Hyperfy v0.9.0 isn’t just a patch — it’s a mutat

Read post

Megacity

Making BODY DOUBLES WITH LOCAL AI

Making BODY DOUBLES WITH LOCAL AI Several AI models and tools allow you to upload a photo of a person, detect or encode their face, and generate new images of that same individual in different backgro

Read post

Megacity

Introduction: A Glitch in the Corporate Machine

In a metaverse dominated by corporate-built engines, Hyperfy V2 emerges like a rogue AI in the system – an open-source, Web3-native anomaly challenging the Unity–Unreal duopoly. Unity and Unreal Eng

Read post